salt tax impact new york

New York claimed in court papers that the SALT cap could cause home equity values in the state to plummet by over 60 billion in-state spending to decrease by 126 to 315 billion and the. Salt Tax New York.

On net even many taxpayers limited by the new SALT deduction had their taxes.

. It is useful to compare the distributional impact of SALT cap repeal to other tax policies or packages. Collected from the entire web and summarized to include only the most important parts of it. 53 rows The SALT deduction also generally benefits states that have relatively large numbers of high-income taxpayers and high-tax environments.

In particular California filers accounted for 21 of national SALT deductions in 2017 based on the total value of their SALT deductions. In New York the deduction was worth 94 percent of AGI while the average across. On April 19 2021 New York Governor Andrew Cuomo signed into law legislation that creates a New York Pass-Through Entity Tax effective for tax years beginning on or after January 1 2021.

The governors office estimates the SALT cap will increase New York. Search only database of 8 mil and more summaries. While the new SALT cap increases federal taxable income for high-income taxpayers these taxpayers benefited from other tax changes.

The people who are in a high tax state like New York California Connecticut and New Jersey and so on are missing out because of the limitation on SALT tax deductions capped at 10000 said. The SALT cap increase will have the biggest effect on high-income-tax states like New York California and New Jersey said certified financial planner Matthew Benson owner at Sonmore Financial. The SALT cap was tucked into the 2017 tax overhaul in part to help finance it and reduce its impact on the deficit.

Unlike most states New Yorks fiscal year begins early on April 1 so it was motivated to act quickly. 11 rows The average size of those New York SALT deductions was 2103802. 52 rows States with high income taxes account for most SALT deductions.

With the SALT limitation in place New Yorkers who already send 40 billion more in taxes to federal coffers than the state receives in return face the manifestly unfair risk of being taxed twice on the same income Nadler said. New York also will allow. The bill passed on Thursday includes some budgetary gymnastics in order to avoid.

But Cuomo said two structural changes to New Yorks tax code might mitigate the impact of the cap on New York taxpayers. The states tax code and estimated the fiscal impact of SALT on New York taxpayers. One obvious point of.

Assuming this taxpayer also owns a home in New York property taxes will consume much of the 10000 federal cap so this SALT workaround will allow the taxpayer to deduct up to 10000 of state and local taxes paid in addition to a 12000 charitable contribution instead of being limited to a 10000 deduction for the total state and local taxes paid. For example in 2017 the average SALT deduction in New York was 23804 compared to just 5451 on average in Alaska. The department estimated that in one year New York State households would pay an additional 123 billion in personal income taxes and the SALT cap could cost taxpayers.

Advanced searches left. New York State Enacts Pass-Through Entity Tax as SALT Limitation Workaround. This consequential tax legislation available to electing pass-through entities provides a.

District Court for the Southern District of New York agreed that Congresss. Blue states like New York and California want to restore the unlimited state and local tax or SALT deduction. Can be used as content for research and analysis.

Salt tax impact new york Saturday February 19 2022 Edit. Standing Together On Severance Tax Essential Economics Essentials Chamber Of Commerce For Most New York Income Tax Filers Salt Deduction Still Isn T Missed Empire Center For Public Policy. While other states are considering workarounds to the Tax Cut and Jobs Acts TCJA 10000 annual limit on the federal deduction for state and local taxes SALT on individual income tax returns New York became the first state to pass actual legislation.

The SALT deduction allows states and localities to shield certain taxpayers from the full force of the tax increases essentially encouraging state and local governments to increase taxes. And it would cost the Treasury at least 80 billion a year at a time when the federal government is already pouring out trillions in new spending. The new lower tax rates expanded child tax credit and limiting of the AMT among others all benefited taxpayers now impacted by the SALT cap.

Salt Tax New York. Going forward leaving untouched the rest of the TCJA changes restoration of the SALT deduction would mainly benefit high-income residents of New York and a handful of other high-tax states. Repealing the SALT limitation is a question of fundamental fairness.

New York made up the next highest percentage of national SALT deductions at 13 of all deductions. Bidens DOJ is trying to preserve the 10000 limiteven though Trump enacted it. Home Blog Pro Plans Scholar Login.

The Trump administrations SALT policy is retribution politics plain and simple Cuomo said. Lifting the SALT cap much more pro-rich than Trumps tax bill. 2 days agoUndaunted by the fact that both the Second Circuit and the US.

New York is already the nations leader. Residents of New York.

Gandhi Assassinated Historical News Indian History Vintage Newspaper

Robert Smithson Robert Smithson Archives Of American Art Exhibition Poster

Salt Tax Increase That Burned Blue States Is Targeted By Democrats The New York Times

Luxury Real Estate Is Headed For A Downturn But The Exodus Of Wealthy New Yorkers Could Create A Bigger Impact On The Real Estate Prices Tax Help Tax Attorney

Royal Residence Compound Architecture Model Royal Residence Architecture

Steam And Darkness Null Steam Dark Photo

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

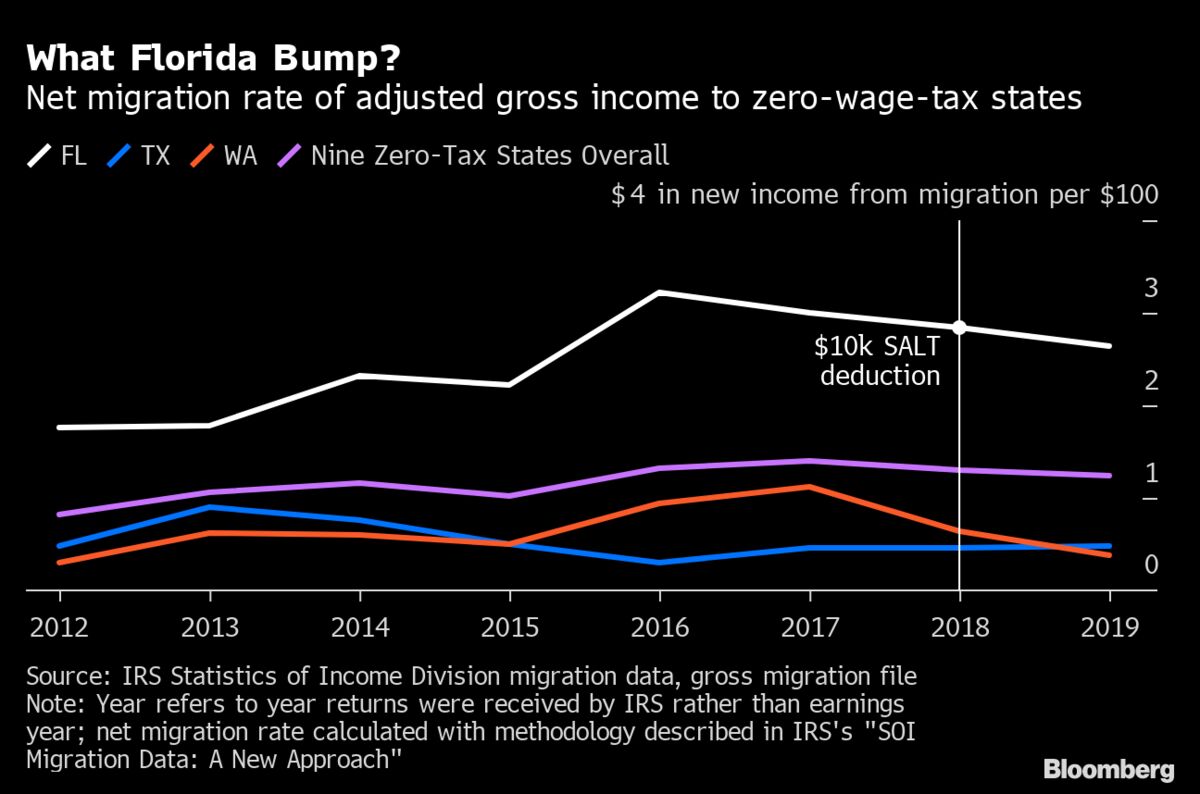

Salt Cap Confounds Doomsayers As Fears Of Exodus Prove Overblown Bloomberg

Munchies Salt Water Taffy Sacramento Ca Old Sacramento Salt Water Taffy Salt And Water Taffy

Jayson Bates On Twitter Cool Places To Visit Beautiful Places To Visit Places To Visit

Keep Calm And Au Revoir Keep Calm Calm Calm Quotes

Vintage 20 First Generation Betsy Walker Doll C 1950 52 Ebay Dolls Betsy Vintage Ads

Relaxing And Invigorating At The Same Time Fishing Www Foodandtravelmagazine Com Fishing Saturday Morning Nature Wildlife Clean Fu Relax Fish Wildlife

Soil Degradation In The United States Pdf Free The Unit Angel Books Agricultural Science

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

Relaxing And Invigorating At The Same Time Fishing Www Foodandtravelmagazine Com Fishing Saturday Morning Nature Wildlife Clean Fu Relax Fish Wildlife

2021 Momentum 397th By Grand Design Uvw 15600 Lbs Hitch Weight 3375 Lbs Length 43 1 Grand Design Rv Rv Living Full Time Grand Designs